1040 Schedule A 2024 Schedule – Tax season — with its homeowner tax benefits — is one of the few times you may actually get some money out of your house instead of pouring money into it. Owning a house in the . “Interest on a home equity loan is tax deductible if the money is used on renovations that substantially improve the home,” says Banfield. So, if you use the money you borrow with a home equity loan .

1040 Schedule A 2024 Schedule

Source : thecollegeinvestor.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comTax Due Dates For 2024 (Including Estimated Taxes)

Source : thecollegeinvestor.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

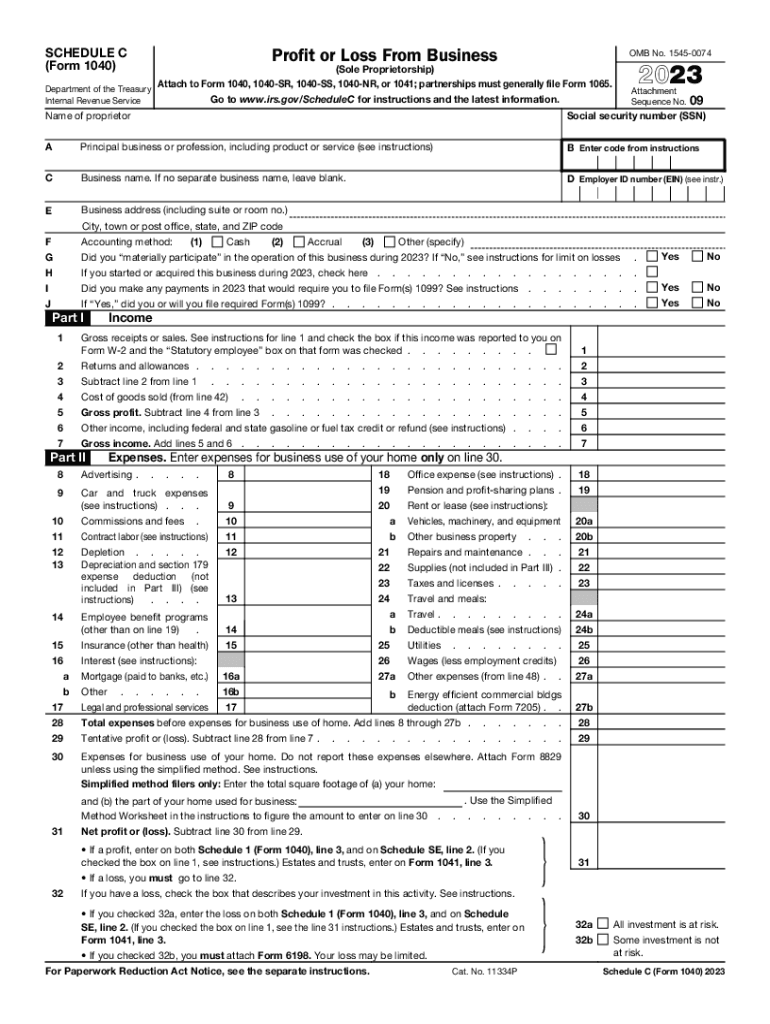

Harbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.kxan.comIRS Announces 2024 Tax Season Start Date, Filing Deadline | Money

Source : money.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comAdventure Off Road Park

Source : www.adventureoffroadpark.comSchedule E Instructions: How to Fill Out Schedule E in 2024?

Source : www.noradarealestate.com1040 Schedule A 2024 Schedule When To Expect My Tax Refund? IRS Tax Refund Calendar 2024: A bipartisan bill that just made its way through the House would expand the child tax service. Here’s what to know. . In 2021, the CTC was expanded after the passage of the American Rescue Plan. That year the tax was raised to $3,600 per child under the age of six, $3,000 per child between ages 6 to 17, and it was .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)